Principal e-Cash Fund FAQ

Part 1: General information: Investment in Principal e-Cash Fund (“Principal e-Cash") through Touch 'n Go eWallet.

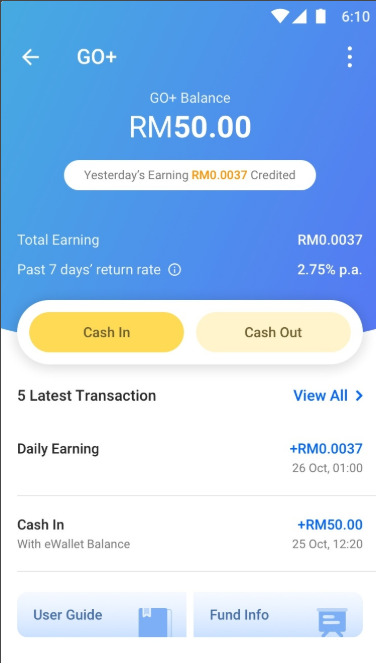

The hallmark of GO+ lies in its flexibility and liquidity. Users can freely use the balance in their GO+ account for daily transactions, while being able to earn potential returns from the available GO+ balance. GO+ benefits include:

- Easy and fast to open the investment account – just reload your GO+ balance.

- Affordable initial investment amount i.e. minimum reload is RM10.

- Seamlessly reload into your TNG eWallet balance via Quick Reload Payment.

- Earn daily returns.

- Make Cash out requests anytime you like.

GO+ is a short-term investment that provides seamless usage capabilities that other investment instruments do not have. It should not be compared with other investments in the capital market.

Payment Order Priority (please refer to the illustrated scenarios below)

- eWallet balance

- Quick reload payment (if customer is registered for GO+)

- Quick payment (Credit/Debit Card) (if customer has enabled this function)

Payment scenario - Online/Offline purchase

| Scenario-1 | Scenario-2 | Scenario-3 | Scenario-4 | |

| Transaction amount | RM3.00 | RM3.00 | RM3.00 | RM3.00 |

| Total balance* | RM4.00 | RM4.00 | RM4.00 | RM5.00 |

| eWallet balance | RM3.00 | RM2.00 | RM2.00 | RM2.00 |

| GO+ balance | RM1.00 | RM2.00 | RM2.00 | RM3.00 |

| Quick payment status | Disabled | Disabled | Enabled | Enabled |

| Source of funds for payment | eWallet balance (full transaction amount deducted) | Payment failed (Both eWallet and GO+ having insufficient balance) | Quick payment - full transaction amount paid with credit/debit card | GO+ balance (full transaction amount deducted) |

*Total balance = eWallet balance + GO+ balance

Payment scenario - Toll

| Scenario-1 | Scenario-2 | Scenario-3 | Scenario-4 | |

| Transaction amount | RM3.00 | RM3.00 | RM3.00 | RM3.00 |

| Total balance* | RM4.00 | RM4.00 | RM4.00 | RM5.00 |

| eWallet balance | RM3.00 | RM2.00 | RM2.00 | RM2.00 |

| GO+ balance | RM1.00 | RM2.00 | RM2.00 | RM3.00 |

| Quick payment status | Disabled | Disabled | Enabled | Enabled |

| Source of funds for payment | eWallet balance (full transaction amount deducted) | Unable to pass toll (both eWallet and GO+ having insufficient balance) | Quick payment - full transaction amount paid with credit/debit card | GO+ balance (full transaction amount deducted) |

*Total balance = eWallet balance + GO+ balance

Payment scenario - P2P Transfer

| Scenario-1 | Scenario-2 | Scenario-3 | |

| Transaction amount | RM10.00 | RM20.00 | RM30.00 |

| Total balance | RM30.00 | RM30.00 | RM30.00 |

| eWallet balance | RM10.00 | RM10.00 | RM10.00 |

| GO+ balance | RM20.00 | RM20.00 | RM20.00 |

| Quick payment status | Enabled/Disabled | Enabled/Disabled | Enabled/Disabled |

| Source of funds for transferring money to other Touch 'n Go eWallet users | eWallet balance (full transaction amount deducted) | GO+ balance | Unable to transfer. The allowable transfer amount is the higher of your eWallet balance and GO+ balance. |

*Total balance = eWallet balance + GO+ balance

Yes, with Quick Reload Payment you can send money to other users via the Transfer function. For more information on Quick Reload payment, please refer to the What is Quick Reload Payment? article.

Step 1:

Tap ‘Transfer’ on your Touch ‘n Go eWallet app’s main page.

Step 2:

Select your recipient.

Step 3:

The higher of your GO+ and eWallet balances will be automatically shown as the maximum amount that you can transfer. Enter the amount you’d like to transfer.

e.g:

• eWallet balance = RM10

• GO+ balance = RM20

• Maximum amount that can be transferred = RM20

Step 4:

Confirm your transfer.

For Touch 'n Go eWallet and GO+ (Unable to reload into Touch 'n Go eWallet, Problem with 6-digit pin, How to Cash In into/Cash Out from GO+)

You may submit your queries to https://tngd.my/careline-webform.

You may also call the Touch ‘n Go eWallet Careline at +(603) 5022 3888. The operating hours are Monday to Sunday, 7.00am to 10.00pm (including public holidays).

For Principal e-Cash (Earning calculation, failed Cash Out to bank account, more info about the fund and Principal Malaysia)

You may email your queries to service@principal.com.my

You may also call Principal Customer Care at +(603) 7723 7262 or chat with us via  (WhatsApp). The operating hours are Monday to Sunday, 7.00am to 10.00pm (including public holidays).

(WhatsApp). The operating hours are Monday to Sunday, 7.00am to 10.00pm (including public holidays).

You must read and understand the contents of the Product Highlight Sheet and Prospectus for Principal e-Cash. Principal e-Cash is a money market fund and investing in it is not like placing a deposit with a financial institution.

Yes, Principal e-Cash Fund, the underlying fund for GO+ is now Shariah-compliant. All Net Asset Value. (NAV) of the Fund will be invested in a combination of cash (at bank), placement of Islamic deposits, Islamic money market instruments and/or sukuk in MYR.

Shariah-compliant investments are investments based on the principles of Islamic finance. The guiding principles of Shariah-compliant investments dictates the investments must not involve any elements of Riba (usury), Gharar (ambiguity) and Maysir (gambling).

Your money will not be invested into companies that generate profits from alcohol, tobacco, gambling, adult entertainment, firearms, banking and conventional insurance.

The Fund does not pay zakat on behalf of Muslim Unit Holders. Thus, Muslim Unit Holders are advised to pay zakat on their own.

Muslim unit holders who have been made aware of previous investment and received returns on their GO+ account before it was made Shariah-compliant are advised to purify or cleanse by channelling their previous returns to any charitable bodies at their own discretion.

Part 2: Upgrade to GO+ and perform 1st Cash In to GO+

Step 1: Complete account verification- you need to submit your ID and personal details via Touch 'n Go eWallet.

Step 2: Update your personal details on Touch 'n Go eWallet.

Step 3: Receive verification that your upgrade is successful, and begin to Cash In to GO+.

Please note: The details requested are part of the mandatory regulatory requirements when you open an investment account, such as Principal e-Cash, through GO+.

• Ensure that you are submitting your MyKad or MyTentera.

• Only capture the front part of your ID.

• Ensure that there is no glare when capturing the photo of your ID.

• Ensure that you are capturing the photo in a bright environment for better picture quality.

• Do not cover your ID with your finger when capturing it, as it may impact the optical character recognition (OCR) accuracy.

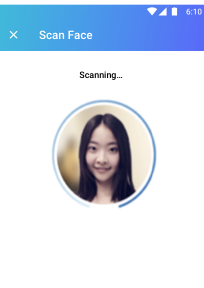

When capturing your selfie, please ensure that your face is within the active area and follow these tips:

• Follow the gesture that is on screen, such as blinking your eyes.

• Ensure your face is within the active area until the circle stops loading.

• Capture your selfie in a bright environment.

Yes. Your individual GO+ account balance limit is RM9,500. Once you reach this limit, you are unable to Cash In to your GO+ account but your account is still able to accumulate daily returns. However, please take note that the aggregate GO+ account balances is currently capped at RM5 billion (“Aggregate Limit”). While a customer has an individual limit of RM9,500, the maximum amount that each GO+ account can hold is still subject to the Aggregate Limit. This means that at any point when the Aggregate Limit is reached, customers will not be able to Cash In to their GO+ account.

- Zero sales charge.

- Management fee of up to 0.45% per annum.

- Trustee Fee of up to 0.03% per annum.

- The daily returns you receive are after all deduction of all fees and charges

- Please refer to the Principal e-Cash Prospectus for further details.

You can Cash In with your Touch 'n Go eWallet balance or your bank account balance via FPX.

(i) For Cash In via eWallet home screen:

Step 1: Tap the "Reload" balance icon.

Step 2: Select "GO+ Balance".

Step 3: Select cash in via “eWallet Balance” or “FPX Online Banking” and then follow through with the instructions.

(ii) For Cash In via GO+ dashboard screen:

Step 1: Tap the "GO+" icon.

Step 2: Select "Cash In".

Step 3: Select "eWallet Balance" or “FPX Online Banking” and follow through with the instructions.

ii) For Cash in via FPX Online Banking, you can only Cash In up to RM9,500 provided that your total GO+ account balance doesn’t exceed RM9,500.

- You might have transferred from an FPX bank account that is not registered under your name.

- You might have failed a bank portal authentication step (e.g. invalid login to bank portal, invalid entry of bank One Time Password (OTP), insufficient funds in bank account, etc).

- You did not meet the necessary requirements.

- Your Touch 'n Go eWallet might have experienced a connection timeout, please try again later.

For any failed cash in via FPX transaction due to third party payment, the amount will be refunded into the respective bank account used for cash in within three (3) business days from day of the transaction, and any applicable bank charges payable shall be borne by the customers.

Part 3: How Do I update my contact information on Touch 'n Go eWallet?

Step 2 : Choose “Edit info.”

Step 3 : Answer the security question(s) and proceed with your changes.

Step 2 : Choose “Change Mobile Number.”

Step 3 : Answer the security question.

Step 4 : Enter your new mobile number.

Step 5 : Enter the OTP that you should receive on your new mobile number.

No, not at this time. You will also need to share your updates with Principal Malaysia by contacting the Principal Malaysia Customer Care Centre hotline at +(603) 7723 7260, chat with us via  (WhatsApp) or writing a request to mygoplus@principal.com

(WhatsApp) or writing a request to mygoplus@principal.com

Part 4: Cooling-Off Request to Principal Malaysia

(WhatsApp); you will be advised and guided on how to perform the cooling-off request.

(WhatsApp); you will be advised and guided on how to perform the cooling-off request.Part 5: Redemption “Cash Out” Transaction

Step 2: Select "Cash Out".

Step 3: Select "eWallet Balance*" or “Bank Account” and follow through with the instructions.

• RM10 if you are requesting for Cash Out to your bank account or Touch 'n Go eWallet.

Below are the maximum Cash Out amounts:

• There is no maximum Cash Out amount if you opt to Cash Out to your bank account.

• The maximum Cash Out amount is depending on your eWallet balance and size, if you opt to Cash Out to your eWallet.

- Your Touch ‘n Go eWallet, the money will be credited instantly.

- Your bank account, the money will be transferred within three business days from your transaction date (T+3) from the successful processing of your Cash Out request if the request is made before 4:00 PM (T). However, if the request is made at or after 4:00 PM (T), it will be treated as a next day request and the money will be transferred within three business days (T+3) from the successful processing of your Cash Out request. You will have to bear the applicable bank fees and charges from time to time.

- However, you may want to check your bank account first as occasionally money has been transferred into your bank account but TNGD will only update the status upon receiving confirmation from the bank 1 day later.

- Facilitate payment to TNGD merchants, the Cash Out amount will be debited immediately from your GO+ balance.

- Your Cash Out transaction is still being processed. It will take up to within two business days from your transaction date (T+1) for the Cash Out transaction to be completed if the request is made before 4:00 PM (T). However, if the request is made at or after 4:00 PM (T), it will be treated as a next day request and the money will be transferred within three business days (T+2). As soon as the name of your eWallet and bank account matches (status: verified), you will see a verified tag and your subsequent Cash Out request will take 2 calendar days (T+1) to complete processing.

- However, you may want to check your bank account first as occasionally money has been transferred into your bank account, but TNGD will only update the status upon receiving confirmation from the bank 1 day later.

- You did not meet the necessary requirements.

- Your Touch ‘n Go eWallet might have experienced connection timeout, please try again later.

- You did not provide all required and accurate information to us. If you fail to complete the Cash Out request by you, non-receipt of the Cash Out request by us or receipt of inaccurate information by us, the Cash Out request will be cancelled automatically.

- You might have transferred to a bank account that is not registered under your name or ID.

- You did not meet the necessary requirements.

- You did not provide all required and accurate information to us. If you fail to complete the Cash Out request by you, non-receipt of the Cash Out request by us or receipt of inaccurate information by us, the Cash Out request will be cancelled automatically.

Part 6: GO+ Dashboard and Transaction history

Part 7: About Daily Earning

• Your total GO+ balance is less than RM10.00.

The Total Expense Ratio (TER) for the fund includes the Management Fee charged by the Fund Manager, as well as other expenses incurred by the Fund (e.g., custody, marketing, compliance, shareholder services); as the TER includes fixed costs, it may vary slightly depending on the size of the fund.

Part 8: Security And Privacy

• Do not share your 6 Digit PIN with anyone.

• Do not share your OTP with anyone. Keep your OTP details safe.

• Step 2: Contact your mobile service provider to block your SIM card immediately, to prevent any attempt to request OTP to reset your TNGD eWallet password/ PIN.