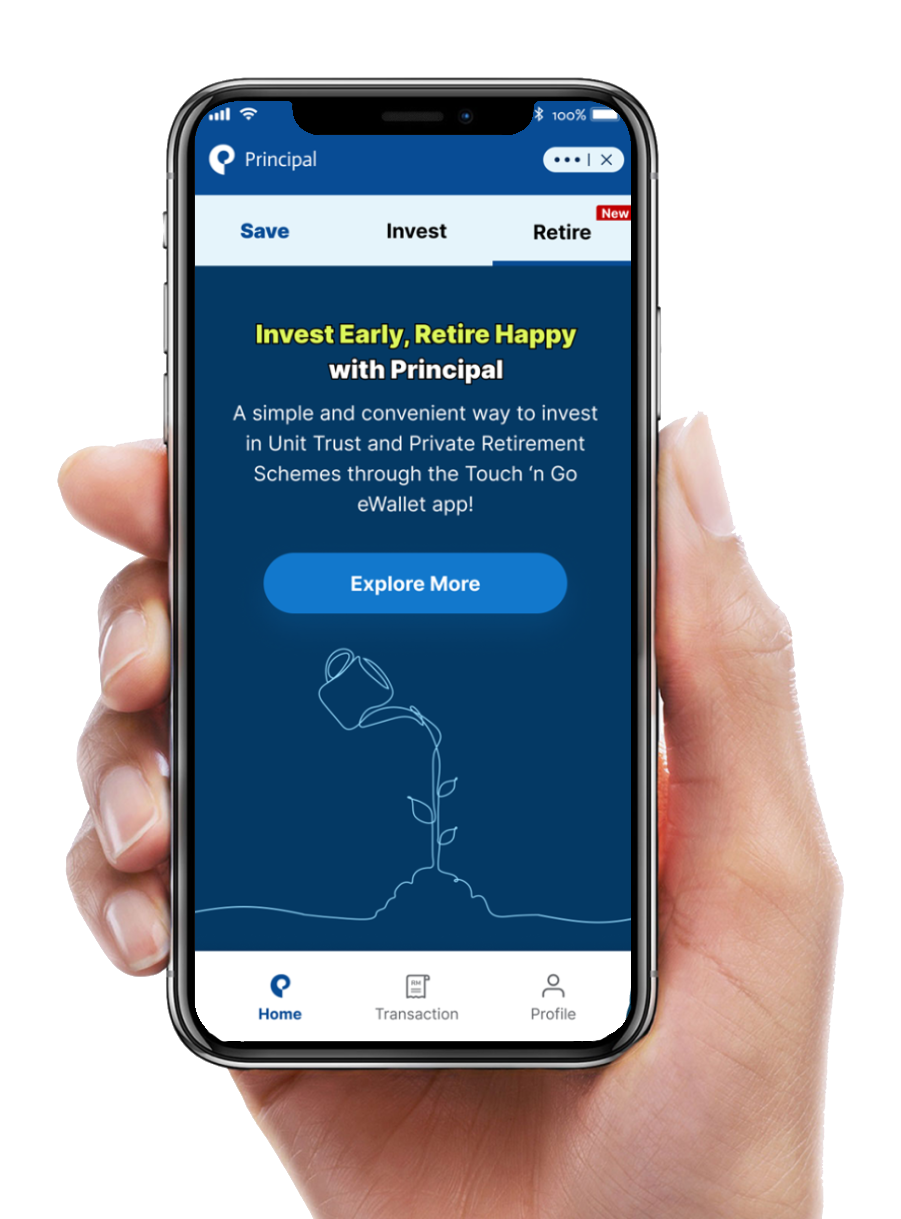

Your financial journey begins here.

Invest smarter with Principal via TNG eWallet, a one-stop feature that gives you access to Principal's Global and Regional funds.

By investing as low as RM10, you can start building your retirement nest egg to achieve your long-term financial goals.

Discover our features

*The projected return is calculated using the expected gross return rate (per annum) from the Fund over the next 12 months, excluding any management and trustee fees.

About the fund

When investing in the SAVE feature, you invest in Principal Islamic Money Market Fund (Class D), a Shariah-compliant fund.

Funds in the Invest feature

#Performance as of 30 September 2024. Past performance is not an indication of future performance.

* Tax relief valid until assessment year 2030.

About the fund

NAV

MYR 0.3145

Change

-0.25 %

NAV

MYR 0.3051

Change

-0.26 %

How to get started?

#For existing GO+ investors, you may skip this step and proceed to next.

Quick step to activate Monthly Auto Cash In.

Frequently asked questions (FAQ)

1. How is investment possible with Principal through Touch 'n Go eWallet app?

You can now invest in Unit Trust funds* (“Fund”) with Principal Asset Management Berhad (“Principal Malaysia”) through GOfinance’s Investment feature.

*See FAQ no. 4 for fund listing.

2. What are the features in this Investment feature?

There are two features as below:

| Feature | Description |

| Save | Save is a goal-based investment feature where you can select and personalise your investment goals(s) |

| Invest | Invest is a new feature that enables investors to invest in Global & Regional in both conventional & Islamic funds for potentially higher returns. |

| Retire | Retire enables you to invest in Private Retirement Schemes to build your retirement fund. |

3. What is the difference between GO+ and Save/Invest/Retire?

| GO+ | Save/Invest/Retire | |

| Purpose | For daily usage Earn daily returns on your balances and use them to make payments. | For Investment An option to diversify and build your investment portfolio. |

| Returns | Daily nett returns of up to 3.45% p.a. or more. | For Save feature Average total returns of up to 15.86% (Since inception until 31 January 2024. For Retire feature Returns of up to 26.80% (Since inception until 30 September 2024). *Past performance is not an indication of future performance. |

| Withdrawal/Cash Out |

| For Save feature

|

| Investment Horizon | Short to mid-term | Mid - long term*

|

4. What is the difference between Save, Invest and Retire feature?

| Investing in “Save” feature | Investing in “Invest” feature | Investing in “Retire” feature | |

| Purpose | For savings An option for you to invest in your financial goals. | For investing An option for you to diversify your investment based on your risk appetites. | For retirement Invest in Private Retirement Schemes to build your retirement fund. |

| Fund(s) | Shariah-compliant Fund

| Conservative

Moderate

Aggressive

| Conventional

Islamic

|

| Cash In | Min RM10 | Min RM10 | Min RM100 |

| Withdrawal/Cash Out | Up to two (2) Business Days to the bank account. | Within seven (7) Business Days. | Refer to Part 5, Q13. |

| Investment Horizon | Short to mid-term | Mid to long-term* *3 years or more. Please refer to the Fund's Product Highlight Sheet for details. | Mid to long-term* Please refer to the Fund's Product Highlight Sheet for details. |

5. What are the benefits of investing via this feature?

- Convenient way to start investing from as low as RM10 (For Save/Invest) and RM100 (For Retire)

- Gateway to Global & Regional Conventional & Islamic funds

- Safe and secure platform

- No investment cap

For fund information, you can refer to the following links: https://bit.ly/FundList and search for the fund name.