7 min read I Date: 18 October 2024

Our thoughts and portfolio positioning going forward1

Equities:

We see Consumer, Healthcare, Utility, Real Estate and Real Estate Investment Trusts (REITs), and Software and Services sectors as direct beneficiaries of Budget 2025 measures. Labour intensive industries such as Plantations, Building Materials, Tech (Semiconductor and Electronics Manufacturing Services (EMS)) and Gloves sectors, however, could be impacted by the minimum wage hike. The absence of punitive measures such as inheritance tax, capital gains tax, and entertainment tax are also welcome news.

The stress on executing greater fiscal reforms and the lower deficit targets despite delays in some of the measures, in particular the RON95 subsidy rationalisation, is encouraging. We remain hopeful that e-invoicing would be a prelude to the introduction of Goods and Services Tax (GST) or some form of value-added tax in the near future.

Also, initiatives to raise income levels through civil servant wage hikes and the raising of minimum wages, coupled with higher cash aids and tax reliefs, should drive domestic consumption. Various new tax incentives should further spur direct investments, which are already gaining momentum.

The above coupled with prospects of the further strengthening of the Ringgit should translate to narrower equity risk premiums and consequently valuation upside for the Malaysian market. We continue to remain constructive on sectors that stand to gain from the strong domestic consumption and investment momentum, spurred by various economic policy thrusts such as the:

- National Energy Transition Roadmap (NETR);

- New Industrial Masterplan 2030 (NIMP 2030);

- National Semiconductor Strategy (NSS); and

- Johor-Singapore Special Economic Zone (JS-SEZ).

In addition, beneficiaries of the stronger Ringgit include Financials, Utilities, Consumer, Construction, Real Estate and REITs, Transport, and Software and Services sectors. We are also positive on Energy- related names but remain highly selective on Technology, favouring those with strong bargaining power.

Fixed Income:

Malaysia's Budget 2025 appears neutral from the fixed income perspective:

- On the back of narrowing fiscal deficit;

- Potential inflationary pressures stemming from subsidy rationalisations and rising income; and

- Robust growth prospects amidst strong domestic demand.

The government's focus to narrow the fiscal deficit will be positive on overall supply demand dynamics. This is highlighted by the smaller net government debt issuance of RM80 billion (gross debt issuance of RM164 billion) in 2025 against net government debt issuance of RM84.3 billion in 2024 (gross debt issuance of RM183 billion) which will result in a drop in total gross debt issuance by about RM19 billion in 2025.

At the same time however, we can expect some inflationary pressure over the execution of subsidy rationalisation, particularly on RON95 by mid-2025, which could have an impact on bond yields. Additionally, a change in spending trends due to the increase in civil servants' minimum salary in February 2025 might give a boost to economic growth via domestic demand, at least during the first half of the year.

In conclusion, we are of the view that Bank Negara Malaysia (BNM) is likely to keep the Overnight Policy Rate (OPR) steady at 3.00% for most of 2025 with potential upside risk coming in from inflationary pressures and robust growth domestically. Premised on the projected inflation and real Gross Domestic Product (GDP) growth for 2025 provided by the Ministry of Finance.

Downside risk meanwhile will stem from the downward cycle of the global economy and monetary policy cycle by major central banks. This backdrop allows for continued support to the domestic bond market with bond yields to remain range bound, which supports expectations of a stable total return for Ringgit bond funds.

Overview of the budget2

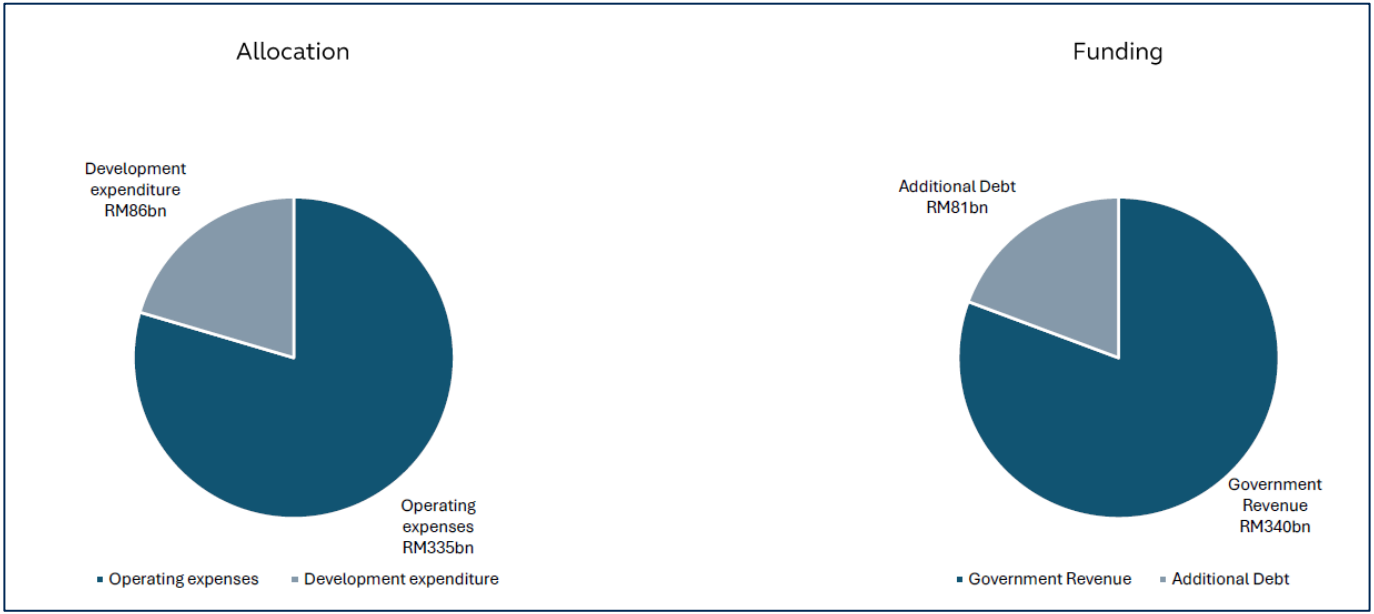

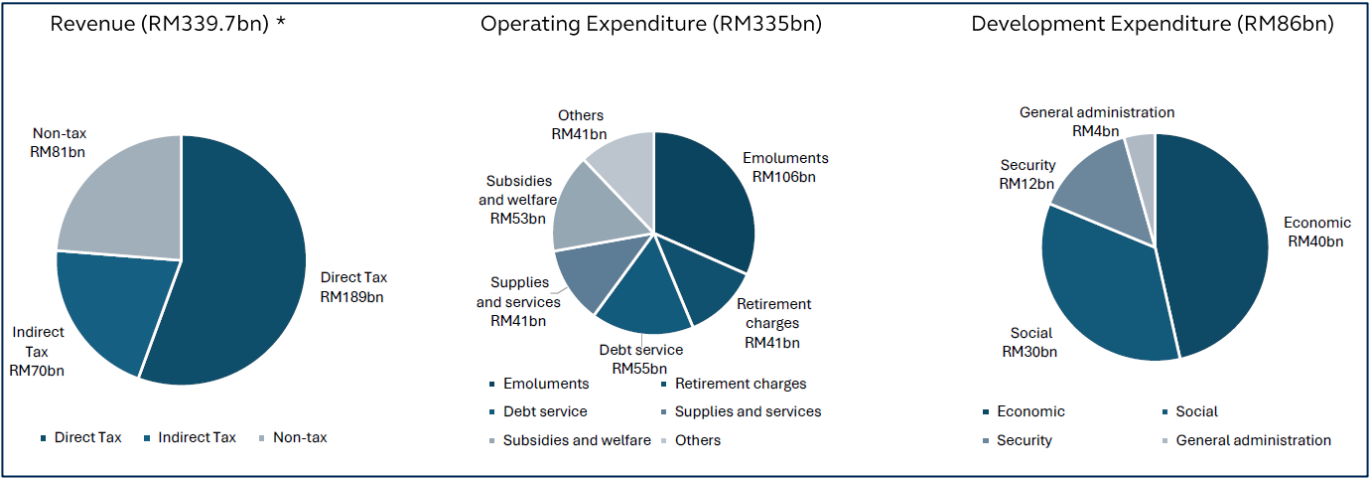

The 2025 budget remains expansionary, with a record allocation of RM421 billion versus RM394 billion last year, with RM355 billion for operating expenditure and RM86 billion for development spending. The higher allocations will be funded by higher tax receipts, partly through higher Sales & Service Tax (SST) collections and other forms of new taxes, and stable dividends from Petronas which were maintained at RM32 billion.

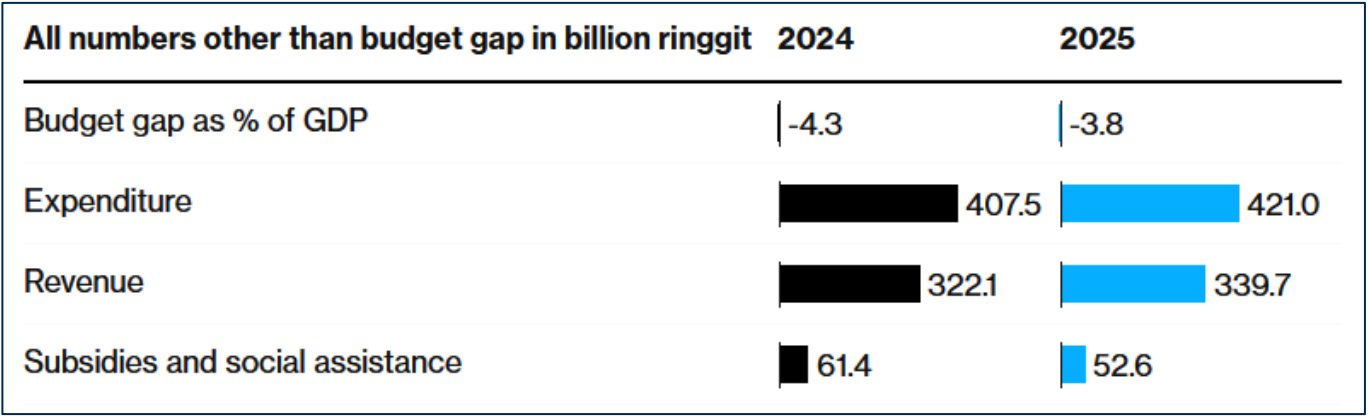

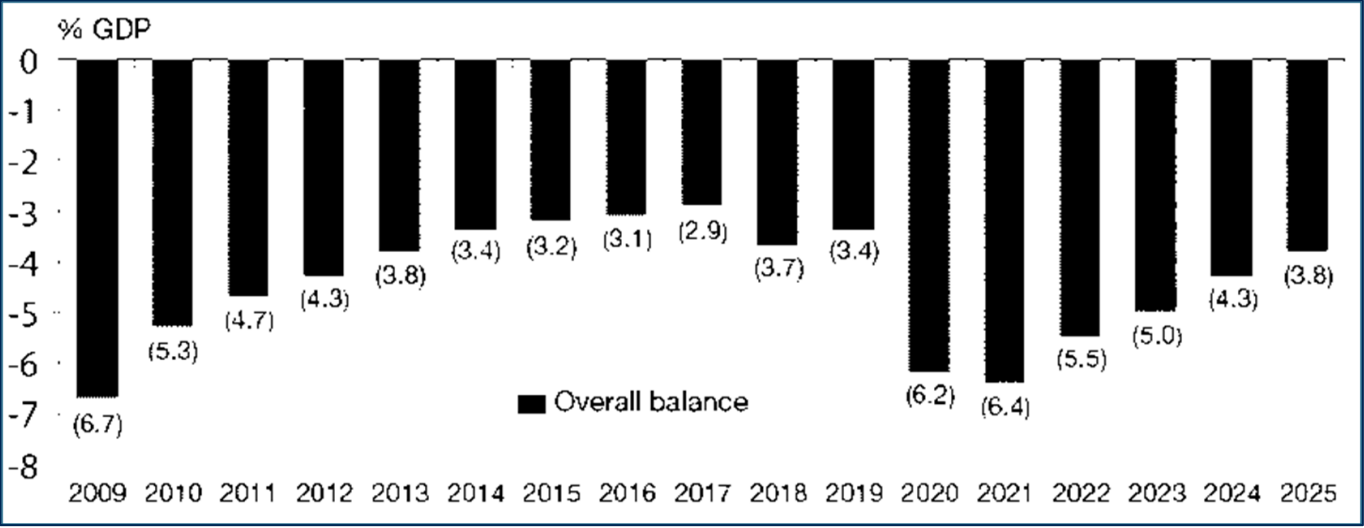

The government remains committed to its fiscal reform agendas. This is via the expansion of the federal revenue base through the widening of taxes and the transition to a more targeted subsidy regime. The development would see the fiscal deficit to further improve from 4.3% in 2024 to 3.8% in 2025, with the federal debt-to-GDP ratio hovering at 64%.

Key highlights2

Economic Growth and Fiscal Responsibility

- The budget aims to enhance Malaysia's attractiveness for hi-tech investments while also addressing the needs of vulnerable groups in society.

- One of the most notable aspects of Budget 2025 is the optimistic projection for economic growth, with estimates ranging between 4.5% and 5.5% for the coming year. This is a positive shift from the previous year's projections, reflecting a robust recovery trajectory for Malaysia's economy. The GDP for 2024 is also expected to strengthen, with forecasts between 4.8% and 5.3%.

- In terms of fiscal responsibility, the government aims to reduce the fiscal deficit to 3.8% in 2025, down from an estimated 4.3% for the current year. This commitment to fiscal prudence is further underscored by a projected decline in new debt, anticipated to be RM80 billion in 2025 compared to RM85 billion in 2024.

Revenue Collection and Taxation

- The budget outlines a significant increase in revenue collection, projected to reach RM322 billion in 2024 and RM340 billion in 2025. This increase is partly attributed to a more progressive implementation of the SST, which will exempt basic food items while targeting non-essential goods. Additionally, a new 2% tax on dividend income exceeding RM100,000 will be introduced, aimed at enhancing government revenue without overburdening the rakyat.

- The Prime Minister indicated that the reintroduction of GST will be considered in the coming years, particularly when wage thresholds rise to between RM3,000 and RM4,000. He acknowledged that while the GST is an efficient tax system, it should not burden the less fortunate segments of society.

Subsidies and Social Welfare

- The government's commitment to social welfare remains strong, with an allocation of RM12 billion in subsidies to assist 85% of the population. Notably, targeted subsidies for RON95 petrol are set to be implemented in mid-2025, ensuring that essential goods remain accessible to those who need them most.

- The minimum wage will be raised from RM1,500 to RM1,700 per month, aimed at improving the living standards of workers.

Investments in Infrastructure and Job Creation

- The government emphasises essential infrastructure development, prioritising projects that directly benefit the public and support industrial growth while moving away from large-scale mega projects. Key initiatives include the Public-Private Partnership (PPP) Master Plan, which aims to increase private investments by RM78 billion and create 900,000 jobs by 2030.

- Larger allocations are made for state development, with Sarawak receiving RM5.9 billion and Sabah RM6.7 billion, reflecting a combined increase of RM200 million from the previous year.

- Infrastructure projects include:

➤ The West Ipoh Span Expressway (WISE); and

➤ West Coast Expressway (WCE), developed under the 'user pays' principle;

➤ alongside RM2.9 billion for upgrading rural infrastructure, which includes RM1.8 billion for village connection roads and RM500 million for clean water and electricity in Sabah and Sarawak. - Additionally, RM2.8 billion is allocated for federal road maintenance and RM5.5 billion for state roads through the Malaysia Road Record Information System (MARRIS), with RM1.35 billion designated for healthcare infrastructure maintenance, including repairs to hospitals and clinics. This budget reflects a strategic shift towards essential infrastructure that enhances public welfare and supports economic growth.

Sustainability and green policies

- Several key sustainability and green policies were announced, highlighting the government's commitment to environmental stewardship. A carbon tax is set to be introduced in 2026, targeting the iron, steel, and energy sectors to align with global standards.

- The Green Technology Financing Scheme will receive RM1 billion to support green projects, while over RM300 million will be allocated to the National Energy Transition Facilitation Fund to promote renewable energy and energy efficiency. Additionally, the Net Energy Metering programme has been extended to mid-2025 to encourage solar energy adoption, and incentives for electric vehicle ownership are being promoted to enhance sustainable transportation options.

Budget Breakdown by Category

First Focus: Sparking Change towards the Pinnacle of Purpose

- Fiscal Responsibility and Debt Management

- Fiscal deficit to decrease to 4.3% in 2024 and 3.8% in 2025, from 5% in 2023.

- Revenue collection revised upwards to RM322bn for 2024. Govt anticipates revenue to further increase to RM340bn in 2025.

- SST to be expanded to non-essential goods and commercial services.

- Dividend tax of 2% on dividend income >RM100k.

- Targeted subsidies for RON95 in mid-2025

- Operating expenditure (RM335bn), Development expenditure (RM86bn)

- Institutional reforms

- MACC (RM360m), National Audit Department (RM200m)

- Allocation to parliament (RM180m)

- Allocation for Legal Affairs Division (RM209m)

- Rakyat-oriented projects and services

- Enhance mobile services for rural communities (RM100m)

- Enhancement of economic activities in rural areas (RM1bn) -Enhance the functionality and UX for MyDigitalID

- Flood mitigation (RM582m), slope repairs nationwide (RM250m)

Second Focus: Revitalising the economy towards success

- New investment incentive framework and strategic investments

- Tax incentives for export enhancement extended to IC design.

- Implementation for global minimum tax on MNCS.

- GLIC will increase DDI by RM120bn over 5 years.

- Investment in data centres, advanced manufacturing etc. (RM500m)

- Khazanah to support local semiconductor industry (RM1bn)

- Investment in start-up companies (allocated RM1bn, RM200bn for 2025)

- Johor-Singapore Special Economic Zone

- Forest city a free trade zone to support tourism and local economy.

- Forest city a free trade zone to support tourism and local economy.

- Food security

- Agriculture (RM300m), Farmer support (RM2.78bn)

- Boost rice production (RM1bn)

- Supporting primary sectors

- Enhance tourism promotions and activities (RM550m)

- Allocation for FELDA, FELCRA, RISDA (RM2.6bn)

- Export market support

- Support the capacity building of local companies (RM1bn)

- Encourage local exporters to expand overseas (RM750m)

- 60% investment tax allowance to logistics companies

- Sustainable agenda and energy transition

- National Energy transition facilitation fund (RM300m)

- Introduction of carbon tax on iron, steel and energy industries by 2026.

- Ecological fiscal transfer fund (RM250m)

- Business assistance and financing

- Business financing and loan facilities for MSMEs (RM40bn)

- Improving the facilities for vendors and small traders (RM100m)

- Financing for halal SMEs (RM600m)

Third Focus: Enhancing People's wellbeing to achieve happiness

- Cost of living

- Increased allocation to STR and SARA (RM13bn)

- Payung Rahmah programme (RM300m)

- Distribution of basic necessities in rural areas (RM250m)

- Rakyat's income

- Minimum wage increased to RM1.7k/month from RM1.5k/month.

- Progressive wage policy in 2025 (RM200m)

- Encourage participation in IPR (RM250m)

- Education

- Fostering education (RM64.1bn to MOE, RM18bn to MOHE)

- School maintenance and upgrading projects (RM2bn)

- Al-related education to be expanded to all research universities (RM50m)

- Funding for TVET (RM7.5bn)

- Healthcare

- Public healthcare capacity (RM45.3bn to MOH)

- Increase excise duty on sugary drinks by 40sen/litre

- Housing

- Tax relief of up to RM7k on housing loan interest payment

- Public transport

- Maintenance of federal roads. (RM2.8bn)

- Public transport

- Tax Maitenance of federal roads. (RM2.8bn)

- Tax Maitenance of federal roads. (RM2.8bn)

- Social protection and empowering Government focus groups

- Aid for young individuals seeking to purchase their first home (RM5bn)

- Govt to build 24 new pre-schools and 16 childcare centres.

- Assistance for senior Citizens (RM1bn), Orang Asli (RM380m)

- Assistance for people with disabilities (RM1.3bn)

- PEKA to help reintegrate inmates into society (RM10m)

Footnotes:

1 Source: Principal view as of 18 October 2024.

2 Source: MOF (belanjawan.mof.gov.my), Bloomberg, Principal as of 18 October 2024.

Any forecasts, estimates and assumptions may be affected by external economic or other factors.

Click here to download the PDF format

What to do next?

- If you need any investment assistance, please get in touch with your financial consultant. (We can help you find one). They can assist you with your investment goals and advice you on your risk tolerance.

- Alternatively, you can also manage your portfolio on-the-go, anytime, anywhere via our online investment portal.

- If you need further assistance, please leave your details here, and we will connect with you.

Disclaimer:

We have based this document on information obtained from sources we believe to be reliable, but we do not make any representation or warranty nor accept any responsibility or liability as to its accuracy, completeness, or correctness. Expressions of opinion contained herein are those of Principal Asset Management Berhad only and are subject to change without notice. This document should not be construed as an offer or a solicitation of an offer to purchase or subscribe or sell Principal Asset Management Berhad's investment products. The data presented is for information purposes only and is not a recommendation to buy or sell any securities or adopt any investment strategy. This material is not intended to be relied upon as a forecast, research, or investment advice regarding a particular investment or the markets in general, nor is it intended to predict or depict performance of any investment. We recommend that investors read and understand the contents of the funds' prospectus/information memorandum and product highlights sheet available on the Principal website, which have been duly registered/lodged with the Securities Commission Malaysia (SC). Registration/lodgement of these documents does not amount to nor indicate that the SC has recommended or endorsed the product or service. There are risks, fees and charges involved in investing in the funds. You should understand the risks involved, compare, and consider the fees, charges and costs involved, make your own risk assessment, and seek professional advice, where necessary. Past performance is not an indication of future performance. This article has not been reviewed by the SC.

©2024 Principal Financial Services, Inc. Principal, Principal and symbol design and Principal Financial Group are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company.

MC0002 | 10/2024 | MB2025