Why Principal Vietnam Equity Fund?

One of the fastest growing economies in Asia

Vietnam’s economy is projected to grow at 6.7% annually for the next five years, outpacing its ASEAN peers.

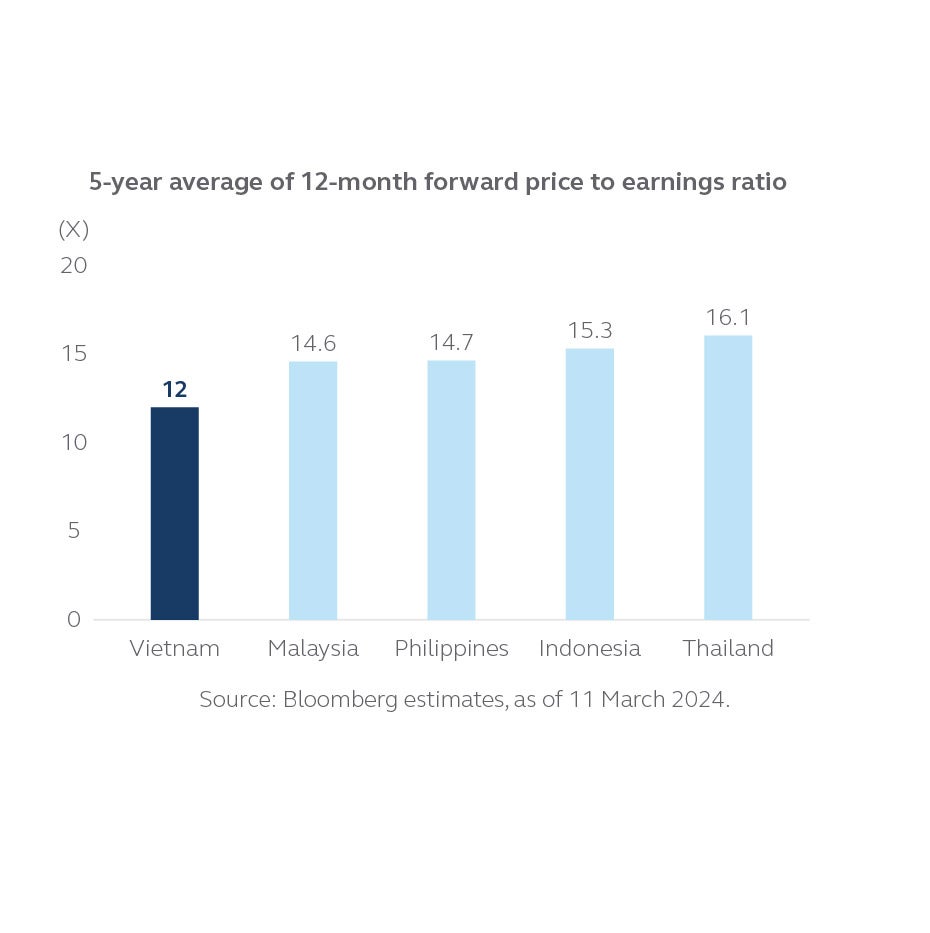

Compelling entry point for Vietnam equities

Vietnam equities’ 5-year average of price-to-earnings ratio is 12x, versus other ASEAN peers ranged from 14x to 16x, indicating that Vietnam equities are in attractive valuation.

Remarkable track record with top Morningstar ranking

The investment team who manages the Vietnam Equity Fund in Thailand has achieved an outstanding historical performance. The fund has been ranked top for all periods# compared with its peers.

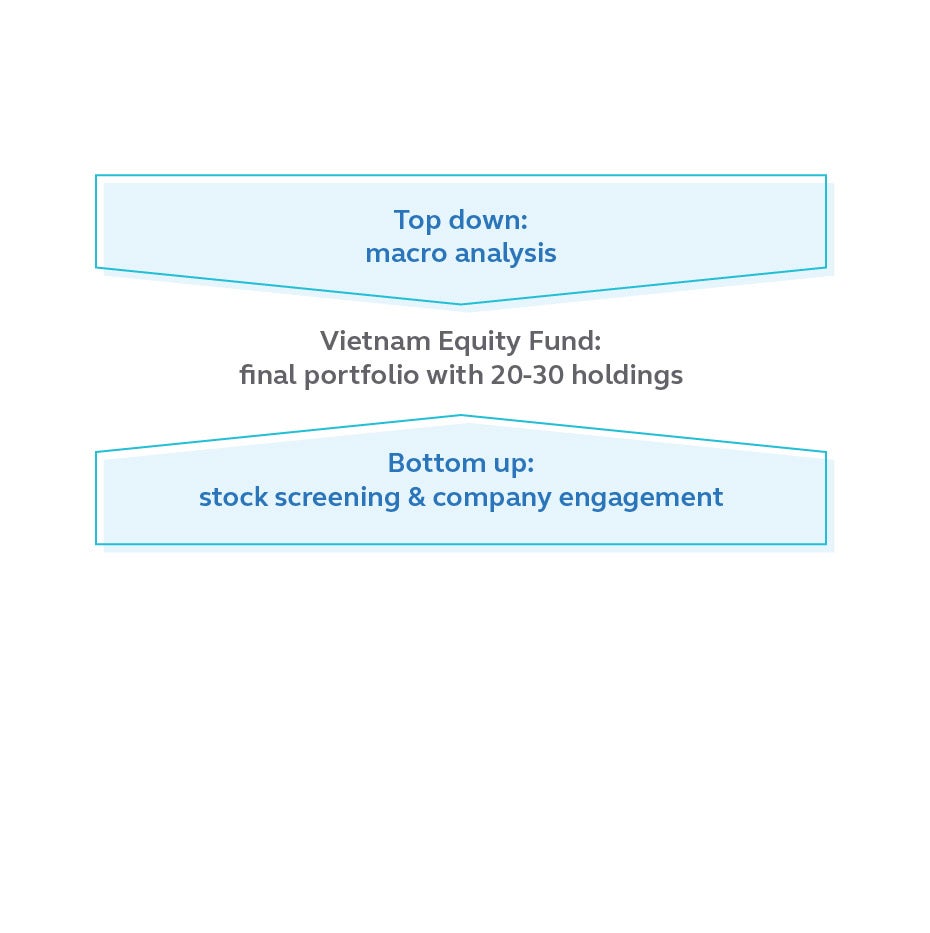

Aim to maximize risk-adjusted return with alpha generation

With macro analysis, in-depth research and disciplined investment processes, the fund aims to capture opportunities ahead of market, ultimately achieving a long-term capital appreciation.

Why invest with Principal ?

| Over 1,000 professionals across Asia bring in-depth local expertise and strong networks to harness distinctive investment opportunities and tailor solutions for our clients.

|

| Ability to leverage global investment expertise with sophisticated investment processes and track records to extend further amplify opportunities for clients.

|

| We have three decades of investment experience and a deep understanding of Asia which have led us to a stronger investment strategies and solutions.

|

How do I invest?

We offer 3 share classes. Click on each class to learn more.

Principal Vietnam Equity Fund (Class MYR-Hedged)

Principal Vietnam Equity Fund (Class USD)

Principal Vietnam Equity Fund (Class D)

Fund Partners

- Unit Trust Consultants

Click here to know more about our fund partner(s).

Disclaimer: We recommend that you read and understand the contents of the Prospectus for Principal Vietnam Equity Fund dated 6 May 2024 which has been duly registered with the Securities Commission Malaysia (SC) before investing and that you keep the said Prospectus for your record. Any issue of units to which the Prospectus relates will only be made upon receipt of the completed application form referred to in and accompanying the Prospectus, subject to the terms and conditions therein. Investments in the Fund are exposed to risks. You should understand the risks, make your own risk assessment, and seek professional advice, where necessary. You can obtain copies of the Prospectus from the head office of Principal Asset Management Berhad, our website at www.principal.com.my or from any of our approved distributors. There are fees and charges involved in investing in the funds. We suggest that you consider these fees and charges carefully prior to making an investment. Investors have the right to request for the Prospectus, Product Highlights Sheet (PHS) and any other product disclosure document; and the documents should be read and understood before making any investment decision. Unit prices and income distributions, if any, may fall or rise. Past performance is not reflective of future performance and income distributions are not guaranteed. You are also advised to read and understand the contents of the Financing for Investments in Unit Trust Risk Disclosure Statement before deciding to obtain financing to purchase units. The registration of the Prospectus with the SC does not amount to nor indicate that the SC recommends or endorses the fund, and the SC does not review advertisements produced by Principal.