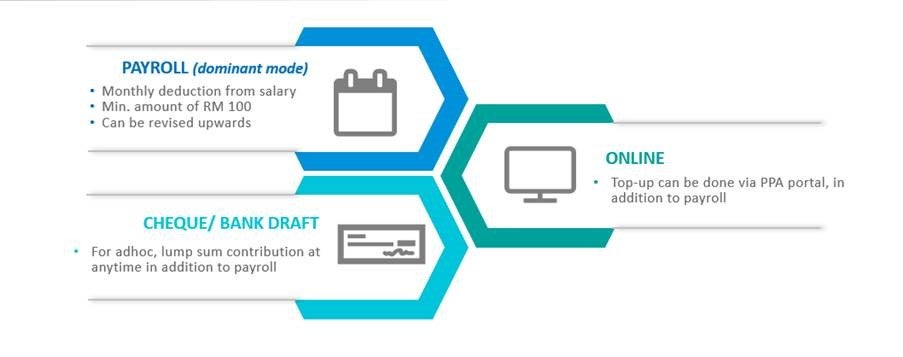

One of the many benefits for enrolling in PRS through your Employer-Sponsored PRS programme is the convenience of setting up payroll deduction to allow for automatic and seamless investing. This is the most convenient way to save for retirement and allows you to “set-it and forget it”. You can later top-up through many modes if you want to contribute more! Here are the different ways you’re able to contribute under an Employer-Sponsored PRS programme:

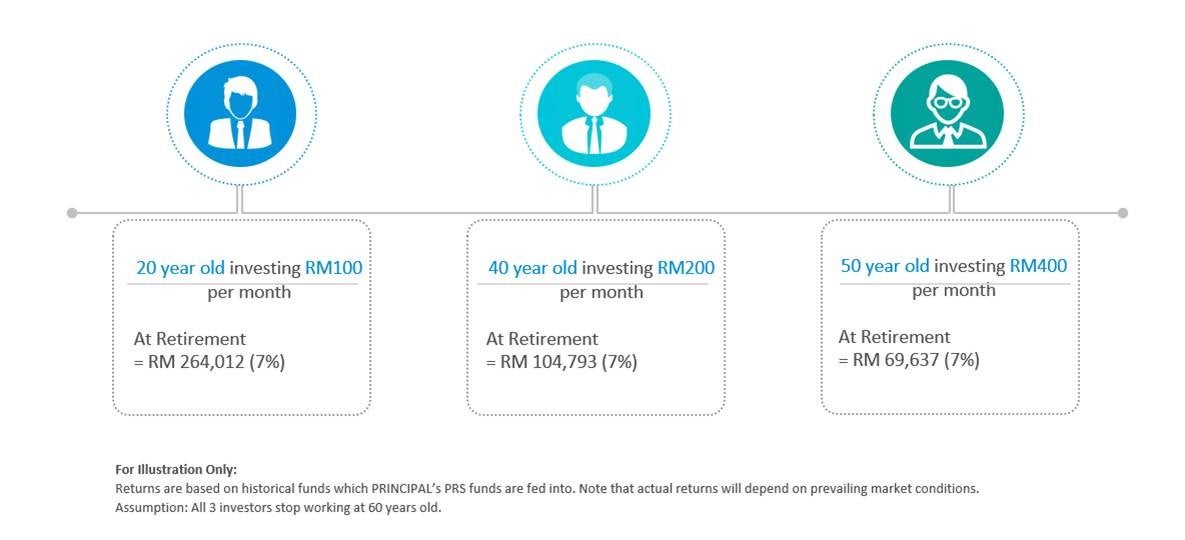

Plus, when you have a regular method of investing, you’re benefiting from “buying-in” at different time periods, otherwise known as “Dollar-Cost Averaging”; essentially helping you spread out your risk and cost over the long-term. Then overtime you benefit from the power of compounding – the earlier you start investing, the more you will accumulate!