5 min read I Date: 20 May 2024

Financial Planning for Beginners

Meet James, a recent graduate who has started his first job in the city. He has multiple goals and dreams such as owning his first car and eventually buying his first apartment. However, these dreams seem far out of reach as he struggles to make ends meet with his salary. Let’s help James build a financial plan so that he can effectively manage his finances and potentially achieve his goals.

A financial plan is a comprehensive assessment of your current financial situation, long-term financial goals, and a roadmap to achieve them. A well‑crafted financial plan not only considers your current financial status - including cash flow, budget, debt, and savings - but also encompasses long‑term goals like retirement savings.

For James, a good financial plan would mean:

√ Being prepared for financial emergencies such as medical expenses or job loss.

√ Moving closer to a secure financial future during retirement.

√ Achieving one or more of his financial goals.

However, it's important to note that there's no one‑size‑fits‑all template for the perfect financial plan. It should be tailored to fit your unique circumstances and priorities.

√ Determine your net worth.

√ Track your monthly expenses.

√ Set short and long-term financial goals.

√ Build an emergency fund covering 3 to 6 months of expenses.

√ Prioritize paying off high-interest debts promptly.

√ Regularly invest to build wealth.

√ Monitor and adjust your financial plan as you progress through different life stages.

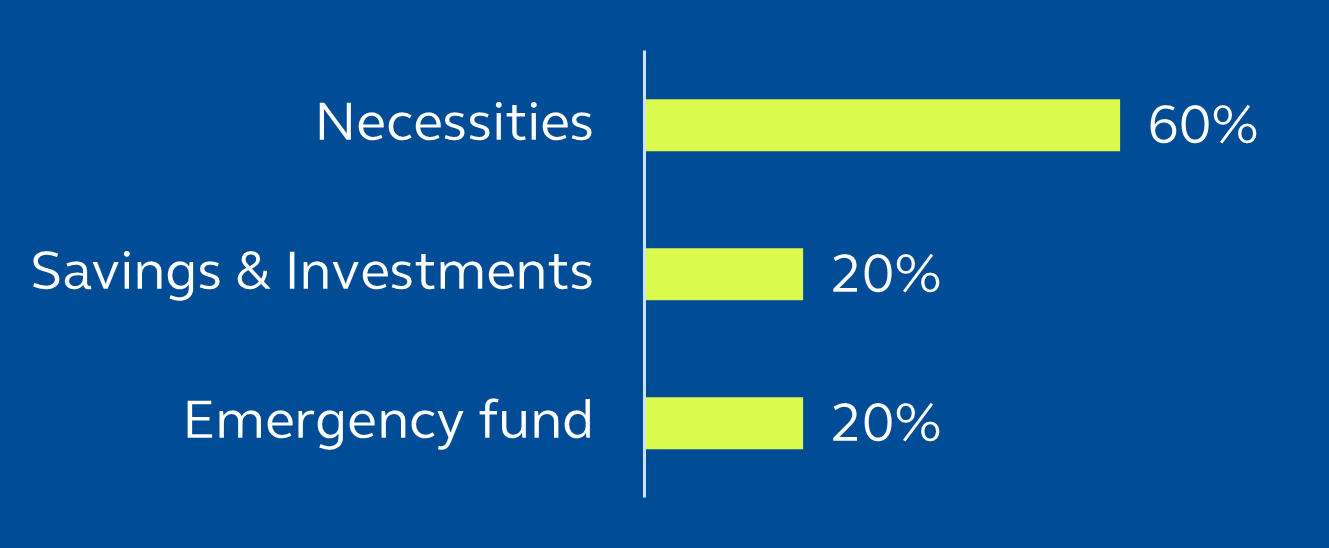

By adhering to this budgeting strategy, you can ensure a balanced financial approach that supports both your immediate needs and long-term financial aspirations.

What to do next?

Enjoy additional bonus of up to 8%* p.a. when you invest with us via Touch 'n Go eWallet's GOinvest Principal "INVEST" feature. New investors will get an additional 1% p.a. Use promo code “INVESTIVAL” by 30 June. Terms and Conditions apply. Please visit this link for more information.

Disclaimer: You are advised to read and understand the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) before Investing. Among others, you should consider the fees and charges involved. The registration of the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) with the Securities Commission Malaysia (SC) does not amount to nor indicate that the SC recommends or endorses the funds. A copy of the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) may be obtained at our offices, distributors or our website at www.principal.com.my. The issuance of any units to which the relevant Prospectus, Information Memorandum and/or Disclosure Document relates will only be made on receipt of an application referred to in and accompanying a copy of the relevant Prospectus, Information Memorandum and/or Disclosure Document. Please be advised that investment in the relevant unit trust funds, wholesale funds and/ or private retirement scheme carry risk. An outline of the various risk involved are described in the relevant Prospectus, Information Memorandum and/or Disclosure Document. As an investor you should make your own risk assessment and seek professional advice, where necessary. Securities Commission Malaysia does not review advertisements produced by Principal.