10 min read I Date: 20 June 2024

What Funds to Invest In ?

Investing can sometimes feel like shopping for a new product. Imagine looking for a skin moisturizer. With so many brands, price points, and ingredients, it can be overwhelming to choose the right one. You might wonder: Do you go for the cheaper option, or do you research to find the best fit for your needs? Similarly, choosing the right investment fund requires careful consideration of various factors.

Understanding Your Investment Choices

When it comes to investing, particularly with the Touch ‘n Go eWallet GOinvest Principal feature, you have up to 16 funds to choose from. How do you decide which ones to invest in? Here are some common questions from our investors, along with helpful insights.

Question 1: Can you invest in funds outside of your risk appetite?

Yes, you can invest in funds that are outside your risk appetite. However, reading and understanding the fund offering documents is crucial before making any investment decisions. By doing so, you are preparing yourself for the outcome.

Question 2: Which funds should you choose?

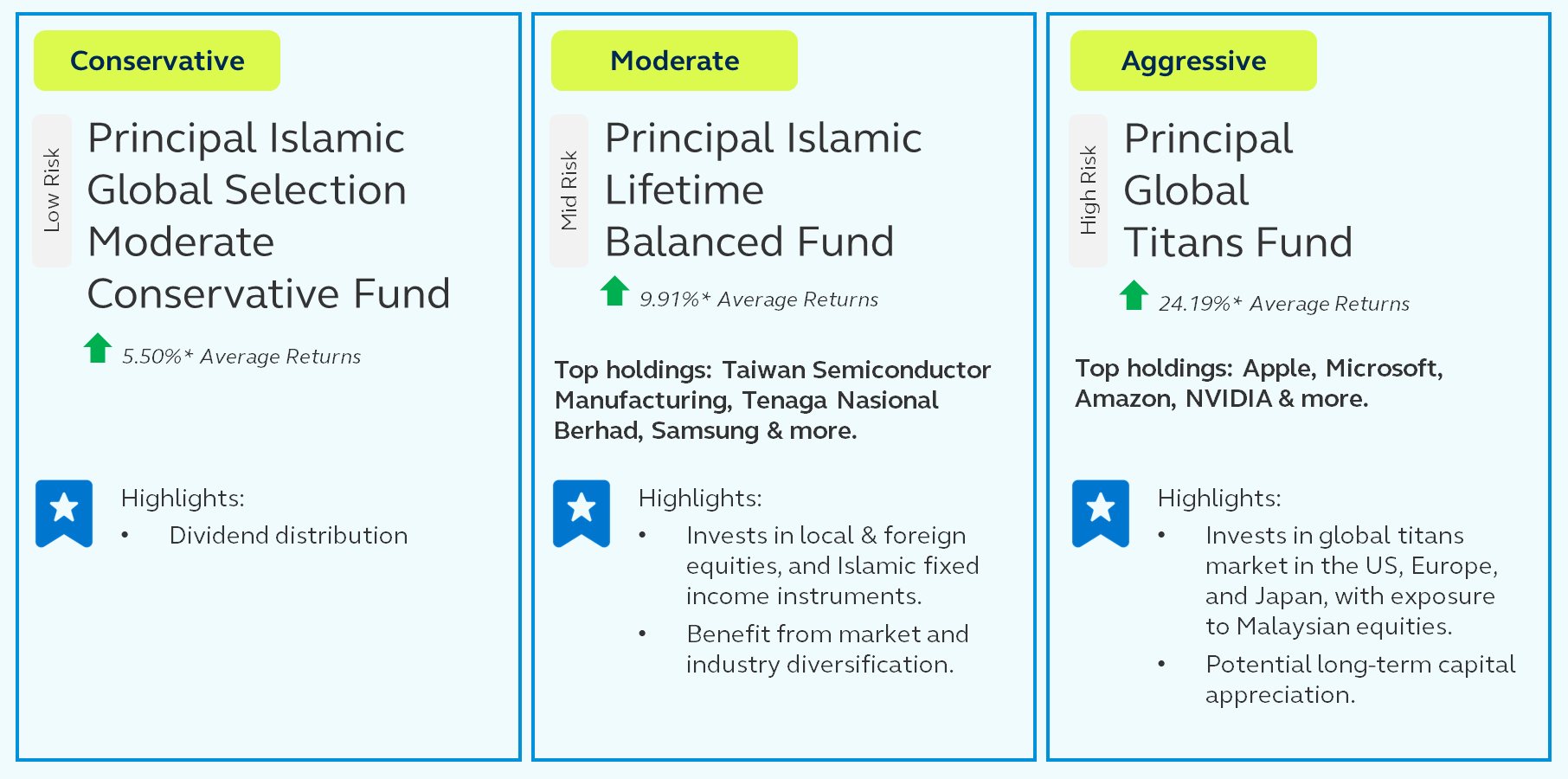

Your fund choices should align with your investment goals, time horizon, and risk tolerance. Here are some suggested funds based on different risk appetites:

*Performance is as of 31 March 2024. Do take note that past performance is not an indication of future performance.

Question 3: Should you evaluate a fund based on its performance?

While performance is an important factor, it should not be the sole consideration. Look at the fund’s market exposure, sectors, and risk factors. A comprehensive evaluation will give you a better understanding of whether a fund aligns with your investment strategy.

Question 4: What should you do if your fund is underperforming?

It's normal for fund performance to fluctuate due to market and sector changes. Stay informed with the latest news and continuously educate yourself. Remember, investing is a marathon, not a sprint.

Question 5: Can you tell me more about Ringgit Cost Averaging?

Ringgit Cost Averaging is a strategy in which you invest a fixed amount regularly. This approach helps mitigate the impact of market volatility by buying more units when prices are low and fewer units when prices are high, potentially lowering your average cost over time.

What to do next?

Invest via the “Invest” feature to earn up to 8% p.a. reward. New investors will get an additional 1% p.a. Use promo code “INVESTIVAL” by 30 June. T&C apply. Please visit this link for more information.

Disclaimer: You are advised to read and understand the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) before Investing. Among others, you should consider the fees and charges involved. The registration of the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) with the Securities Commission Malaysia (SC) does not amount to nor indicate that the SC recommends or endorses the funds. A copy of the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) may be obtained at our offices, distributors or our website at www.principal.com.my. The issuance of any units to which the relevant Prospectus, Information Memorandum and/or Disclosure Document relates will only be made on receipt of an application referred to in and accompanying a copy of the relevant Prospectus, Information Memorandum and/or Disclosure Document. Please be advised that investment in the relevant unit trust funds, wholesale funds and/ or private retirement scheme carry risk. An outline of the various risk involved are described in the relevant Prospectus, Information Memorandum and/or Disclosure Document. As an investor you should make your own risk assessment and seek professional advice, where necessary. Securities Commission Malaysia does not review advertisements produced by Principal.